The other day my brother sent me an image he saw on Instagram.

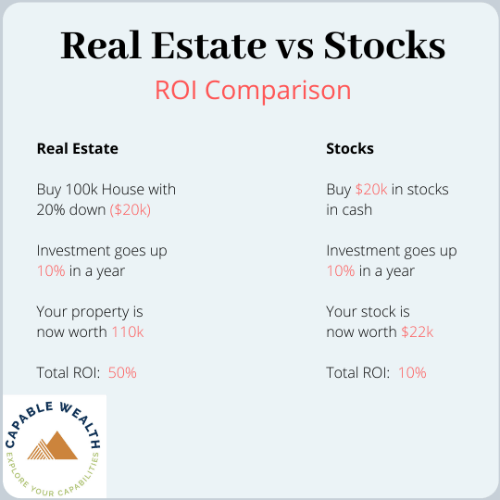

Some account that is tied to Real Estate put out an image that was comparing the investment returns of putting the same amount of money into either Real Estate or Stocks.

The example they gave was the following:

If you invest $20,000 in either asset, what will your total ROI (Return On Investment) be after a year if both go up 10%?

In the case of real estate, they assumed you are putting down 20%, to purchase a $100,000 piece of property. 20% is the typical amount put down for a conventional mortgage.

If your $20,000 stock portfolio goes up 10%, it is now worth $22,000.

If the home goes up in value 10%, it is now worth $110,000. (Remember, you are just putting down 20% of the purchase price and using a mortgage)

So, in both scenarios you invested $20,000. With the stock market, you received a $2,000 return. But in the case of real estate, you received a $10,000 return, which equates to 50% of the money you initially invested.

Here is a chart I made that is similar to the one used:

Looks pretty good, right?!

NOT TELLING THE WHOLE STORY

My brother was asking me if I saw any issues with this comparison, and if so, what?

The main issue I see is that the person who created the chart is leaving out a hoard of information.

There isn’t anything that is false, per se, it just conveniently leaves out a lot.

Things like…

- Closing costs

- Taxes

- Homeowner’s Insurance

- Maintenance & Repairs

- Capital Expenditures

If you begin to add up those additional costs, your invested capital in real estate becomes a much larger number. And this doesn’t even factor in the reality that a lot of these things might be unexpected to many, and cause stress and anxiety.

The flip side is that the example also doesn’t include potential costs of investing in the stock market. Things like trading fees, expense ratios (if you are using mutual funds or similar investment vehicles), taxes, etc.

REAL ESTATE STILL WINS

Either this person was intentionally skewing the numbers or just didn’t know what they were talking about.

Either way, I’m still a huge fan of investing in real estate.

When you factor in all of those previously mentioned expenses, real estate still wins from a purely numbers standpoint. But this is mainly if you are purchasing multi-unit rental properties.

If you are purchasing a single-family home, then it’s a bit different.

To read more about real estate investing, check out some previous articles I’ve written…

[3 Reasons Why You Shouldn’t Buy A Home (And One Reason Why You Should)]

[The 5 Key Reasons Why Real Estate Investing Is Awesome]

LOOK BELOW THE SURFACE

Whenever you are evaluating an investment you need to look past the headline numbers.

Ask yourself, what other factors haven’t been accounted for? Are there any additional costs or risks associated with this investment?

Only by digging deeper will you understand all of the risks and rewards.

And if someone is giving you advice, be sure to get a second opinion in order to verify you aren’t missing any of the important information.

It’s nice that they would offer you some “help,” but not everyone has your best interests in mind.

Capably Yours,

Jared