Trying to force yourself to stop spending money is an extremely difficult task.

Many financial “gurus” talk about the things you need to cut out of your life in order to increase your savings rate and build wealth. But they talk about it as if it were an easy change – as if you could simply flip a switch and stop spending.

If this were true, why do so many of us struggle with overconsumption and a lack of savings?

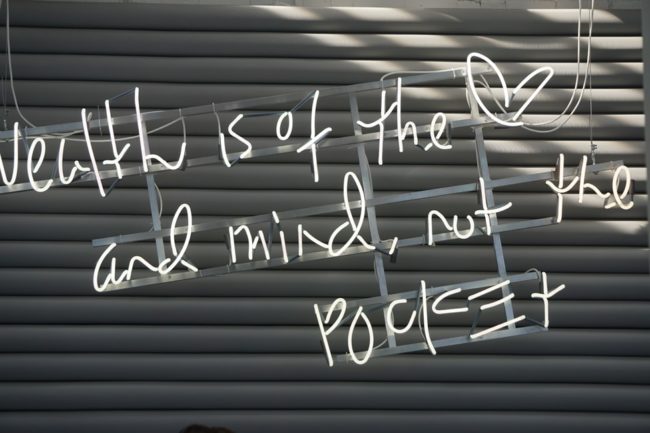

It’s because it isn’t true. Saving money is a difficult endeavor. But it can be made a lot easier if you have the right mindset about it.

FROM PUNISHMENT TO POSITIVITY

One of the biggest shifts you can make surrounding saving money is the change to looking at it as a positive experience instead of a punishment.

I can’t begin to count the amount of times I’ve heard people justify spending their money on a meaningless purchase by stating that they “worked hard for their money and earned the right to spend it however they please.”

This is a very fair point, if it was being used for the right reasons.

Most people are usually just trying to justify an expenditure that really isn’t necessary. So, instead of having to battle with the purchase in their mind, they just default to a response like the one above.

It is true, you have worked hard for the money you have, and you have earned the right to do whatever you please with it.

But why spend that money only to enrich some business that doesn’t really care about you? Why not take the next steps toward building wealth, by saving your hard-earned money, investing it, and then make that money work for you!?

[The 5 Things You Can Do With Their Money (And What The Wealthy Do)]

The reason people never take those next steps is because they have a negative view about saving and investing – They view it as a punishment: not being allowed to enjoy the money they’ve earned.

But this shows that people aren’t thinking about why you earn money in the first place.

It isn’t just so you can go blow it on stupid things you don’t need. The main reason is to survive and sustain your well-being. After that, you begin to move into the enjoyment phase of utilizing money. But outside of that, all of the mindless junk you buy is only forcing you to continue working more than you need to be.

[I Bet You’ve Never Thought Of Money Like This]

TONY ROBBINS’ ADVICE ON BEHAVIOR CHANGE

Tony Robbins is one of the biggest names in personal development. He has helped millions of people cultivate massive changes in their lives.

In a piece on his website, he talks about how reshaping your mentality around any situation can have a profound impact on both how you view that situation, and how you respond to it.

If you use this process when talking about spending vs. saving, it can really help alter the course of your financial future.

Think about a recent time you had to decide between being “responsible” with your money by saving it, versus spending it on an unnecessary purchase.

You probably battled in your mind about justifying the purchase. Maybe you avoided temptation and were able to keep your money in your wallet, but you walked away feeling like you had missed out on something you would have enjoyed.

If we use Tony’s advice on reshaping the context and narrative of a situation, your self-talk might go something like this:

“You know, I’m sick and tired of worrying about money and stressing out about my bills and how I’m going to pay them. Instead of give my hard-earned money to some company, I’m going to save it so I can build up my savings account. This way, I won’t be stressing out anymore when it comes to my finances!”

How great will it feel when you actually reach that point!?

THIS is what you should be focusing on!

Instead of focusing on the fact that you aren’t buying that new item, focus on the fact that you are building a more resilient financial foundation, and moving toward a place in life where you don’t have to worry about money, bills, debt, or what you’d do if you lost your job.

Every time you DON’T spend money, you move yourself closer to this place of financial awesomeness!

HOW YOU CAN MAKE SAVING MORE ENJOYABLE

So, now that you know saving doesn’t have to be a punishment, and it can be an enjoyable experience, here are some ways to increase the likelihood of success with your savings goals.

GAMIFY YOUR SAVING

One way people make saving money a fun experience is to turn it into a game/competition.

You can set goals each week for how many times you can forego certain expenditures – like that afternoon cup of coffee, or going out to dinner instead of eating in.

Each time you reach a particular goal you can reward yourself with a predetermined prize. Let’s say, every time you save $500 you get to treat yourself to a 60-minute massage.

On that note…

REWARD YOURSELF FOR YOUR SUCCESSES

As Tony Robbins stated, you need to bring a positive mindset to what you are doing. One way to do this is to reward yourself when you do a good job.

Humans respond to incentives, so, by incentivizing yourself to save more, there will be a higher probability of success.

Just make sure that the incentives make sense. You don’t want to immediately go out and spend all the money you just saved.

In fact, your reward doesn’t even have to be a big expenditure. Maybe it’s something small, like going to get ice cream.

Whatever it is, make sure it’s something you’ll enjoy and look forward to. The more you want it, the more it will incentivize you to stick to your goal.

CREATE A FINANCIAL “CHEAT DAY”

This is similar to setting up a reward for yourself for a job well done.

In Tim Ferriss’ book “The Four-Hour Body” he talks about his “Slow Carb” diet that has helped a host of people lose huge amounts of weight.

One of the tricks he advises people utilize to ward off cheating is to actually plan a “cheat day.” Throughout the week, whenever you are tempted to deviate from your diet, you are supposed to write down whatever it is you were thinking of eating.

Maybe those chocolate chip cookies were screaming at you when you stopped by the grocery store. (FULL DISCLOSURE: Chocolate chip cookies are my weakness. :p)

In that moment, you should add chocolate chip cookies to your “cheat day” list. And instead of telling yourself “no” you are telling yourself, “not now, just wait a few days and you can have some on your cheat day.”

This little mental hack helps increase your mind’s ability to accept denying the momentary gratification. It isn’t a hard “no,” it’s just a soft “later.”

You can use this same system for financial expenditures. Try and hold off on certain items as long as you can, or until a financial “cheat day.” You may realize, by the time that day comes, that you don’t really need it at all

Once again, this doesn’t mean you should go crazy and negate all of the good that you’ve done. But it helps to have something to look forward to.

SET RULES FOR SPENDING

Kevin Rose is an American internet entrepreneur who has had a very successful track-record in the business world.

During an episode of the Tim Ferriss Show, Kevin detailed a rule he uses to curb impulse purchases.

Anytime he is tempted to make a purchase that will be $100 or more, he has to wait 30 days before making the purchase. This is for non-essential things, like a book, or some new tech gadget.

He will add it to his “wish-list” on Amazon.com, and then revisit the list at the end of the month. Only if he still feels strongly about the purchase will he then make it.

Kevin says that the vast majority of the time, he no longer feels compelled to buy the particular item, so he deletes it form his wish list and never makes the purchase.

Simply by creating a waiting period, he is able to substantially decrease the number of items he purchases.

Pick your own price threshold and timeframe and see how it goes!

GET AN ACCOUNTABILITY PARTNER

Group fitness is all the rage these days. Whether it’s CrossFit, HiiT training at your local gym, or Orange Theory, more and more people are flocking to these types of fitness atmospheres.

One big reason is the sense of community. Humans are tribal creatures, and want to feel like they belong to a group.

This same communal aspect creates an atmosphere of encouragement and accountability.

In order to keep you on track with your saving and investing goals, it can be a great idea to get an accountability partner, or even form an accountability group.

Schedule regular check-ins with each other to see how things are going. And use these times to celebrate your successes!

Having someone who is going through the same thing as you will help during the difficult times.

It also feels great to tell someone when you’ve made a major breakthrough!

DO WHAT WORKS BEST FOR YOU

Making changes with your money habits won’t be easy, and it isn’t just about simply implementing the change; it’s about changing your mentality around those habits.

Personal Finance is much more emotionally based and psychologically centered than people realize.

This stuff isn’t easy, but there are plenty of ways for you to make it easier.

You just have to figure out what works best for you.

Capably Yours,