Every day, you wake up and are faced with choices. The decisions you make for each of these choices have an impact on your life. They dictate where you will go in the future, the person you will be, and the type of lifestyle you’ll be living.

One of the more difficult questions you are faced with is, “What should I do with my money?” Every time you look at your phone, turn on the TV, or read an article, there seems to be an overwhelming number of options to choose from. “Buy this, buy that, put your money here, do this NEXT BIG THING!” And on and on and on…

So, what should you do with your money?

I like to think about this question in the most basic way I can. I also like to think about the differences between those who have amassed wealth and those who haven’t.

By thinking this way, it helps me simplify each decision and also provides insight into what I can do to improve my financial wealth.

YOUR OPTIONS

So, what are the options for your money?

When you get rid of all the noise, you can break it down into 5 categories.

- Spend

- Save

- Invest

- Give Away

- Pay Taxes

Let’s dive into each of these areas and see what actions you can take to implement them in your daily life.

SPEND

This is straightforward. We live in a consumer-driven society, so I’m sure you are all familiar with how spending your money works. What you might not be familiar with is the hidden costs of spending your money.

Not only are you losing out on the money you are spending every time you swipe your credit card or hand over a wad of cash, you also have to deal with sales tax and the missed opportunity of growing that money.

Because of a little thing called sales tax, the penalty for spending your money can be high. I’ll give an example of this further down in this post.

Actions To Take: Go crazy! Buy everything you see. Any extra money you have left over after paying for your basic needs, get out there and spend, baby! Someone has to fuel our economy, so why not make it you? [In case you weren’t clear, this is incredibly sarcastic and I do not recommend this at all! ?]

SAVE

Saving your money is definitely better than spending it. It’s the early stages in the turning point from being a pure consumer to being a wealth builder. The problem is, by simply saving your money you aren’t leveraging the power of investing, nor are you utilizing tax strategies that can help you minimize your tax-burden and help accelerate your wealth building.

Actions To Take: Put your money into a checking account, savings account, or other form of low- to no-risk account. Your money will be safe, but it is just sitting idle, not working for you.

INVEST

This is where the good stuff begins, where real wealth-building is accelerated.

If you haven’t heard of it before, compound interest is one of the driving forces for creating wealth. It’s the concept that your money can keep growing, earning interest, and building upon itself.

In my example below you’ll see how this works. I’ll also be writing about this more in the future.

Actions To Take: There are a lot of options. The easy ones are investing in stocks, bonds, ETFs, Index Funds, and more. Others that I really like: investing in real estate and/or starting your own business.

GIVE AWAY

Charity is a great way to give back to those who are less fortunate. I like to think that you can always do something, no matter what stage of your wealth building you are in. You don’t have to be a billionaire to donate to charity.

One thing the wealthy know is that charitable donations are tax write-offs. So it can actually benefit you to do good!

Actions To Take: Find a charity that is close to your heart and make it a point to donate each year. It doesn’t have to be a lot, but it’s good to get in the habit.

A close friend and I founded a charity golf event that we host each year. The purpose is to help raise awareness and support the fight against cancer and muscular dystrophy.

PAY TAXES

To a certain extent, you do have a choice in this matter. You obviously can’t choose to not pay taxes, but you do have the ability to leverage the rules in the tax code to minimize the amount you pay. Burying your head in the sand and not paying attention to this is a great way to ensure you pay more taxes than necessary.

It’s not what you earn; it’s what you keep at the end of the day that matters.

Actions To Take: You can either familiarize yourself with some tax strategies or hire a qualified tax professional for help in minimizing your tax burden.

WHAT THE WEALTHY DO WITH THEIR MONEY

If you read books about the most successful people, you’ll hear them mention some of the things that helped them become successful. One of the pieces of advice I often hear is to look at those doing better than you and emulate them.

If someone is better than you at something, you should find out how and why, and you should probably consider implementing the things they are doing into your own habits.

This is one of the big reasons I recommend looking to what the wealthy are doing with their money.

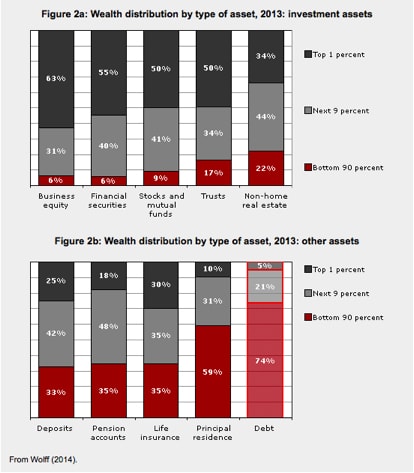

In a piece titled “Wealth, Income, and Power” by G. William Domhoff, they show a breakdown of wealth by asset classes.

If we look at the following chart from the piece, we start to see the differences.

Original Study

The above chart shows how much of each category is owned by the top 1% of wealthy individuals, the next 9%, and then the bottom 90%.

The main things I see is that the wealthy hold a lot of their assets in investments in the form of businesses, financial securities, trusts, non-home real estate (investment properties), and then some in deposits (cash savings, i.e. – an emergency fund or just some safety cash).

If we look at the bottom 90%, you can see that they own a large portion of the debt and principal residences (their primary home). What they don’t own a large portion of is the different categories of investments.

What isn’t shown in this chart is the focus the wealthy put on tax savings. In short, they put a lot of effort into minimizing their tax burden so they can use those tax savings to propel their wealth creation.

Those who are wealthy also give away a chunk of their money in philanthropic endeavors. (Power tip – As I mentioned before, charitable donations are a tax write-off. So you can be rewarded financially for doing good).

THE EFFECTS OF YOUR CHOICES – A CASE STUDY

I live in New York. In a lot of circumstances, you will pay sales tax of 8.875%. (I’m going to spare you the headache of getting technical with the tax code.) This means that every time someone living in New York buys something, they are being hit with an 8.875% penalty.

Buying a $100 pair of shoes? Boom! $8.88 penalty tacked on.

Buying a new TV for $500? Boom! $44.34 penalty tacked on.

We have become so accustomed to paying sales tax that we don’t realize the negative effect it’s having on our wealth.

That’s A Double Whammy!

What makes this even worse is when you start to factor in the lost opportunity of investing.

Let’s assume you had invested that money. If we use an investment return of 10% over the next year, we start to see the difference our decisions make. (Some will say you should expect more, some will say less. I’m just going to use a round number to make things simple.)

By buying that $500 TV, not only are you being penalized the $44.34 in the form of a tax, you are also missing out on the potential $50 investment return you could have received. That’s a $94.34 difference your decision makes.

Wait, that’s right, you also SPENT $500!

So your total change in wealth isn’t between spending or saving the $500, it’s a total difference of having $550 at the end of a year, and having spent $544.34. The total difference: $594.34.

What if you make similar decisions each year for a 10-year period?

Over the course of the 10 years you will have put $500 per year into your investment account, totaling $5,000. If you earned an average return of 10%, at the end of the 10 years it will be worth $9,265.58.

That’s in contrast to spending $544.34 (Cost of TV plus tax) each year for a total spending of $5,443.40.

I know what you are going to say. “Jared, I’m not going to buy a new TV every year.” The example is just showing how all of your spending adds up.

What is the net difference in the end result?

The difference between where you would be versus where you could be ends up being a whopping $9,708.98!

So, now that you know what you CAN do with your money, the question becomes what WILL you do with your money?

Capably Yours,