I recently sat down with a new client to discuss her situation and plan for the future. She is battling with her spending and trying to gain control of her finances.

Like many, she is spending too much in relation to her income and it is causing her stress and anxiety.

It’s also causing her to forgo certain things she’d love to be doing.

The reason many people find themselves in this situation is because they don’t engage in what is called conscious spending.

WHAT IS CONSCIOUS SPENDING?

If the term sounds foreign to you, it could be because most people don’t engage in it, and rarely talk about it.

Conscious spending is when you actively choose what you will and won’t spend your money on.

You might be tempted to say that you do this. After all, whenever you are spending money, you have to actively hand over your hard-earned cash or swipe that credit card in order to receive whatever service or product you are purchasing.

But the sad fact is that most of the spending people do is reactionary, and rarely thought out in advance.

Maybe your friends booked a reservation at the new chic restaurant in town and want to know if you are free to join.

Not a “foodie?” Then maybe it won’t be the worst thing to pass it up.

Are some friends planning to go see a concert this weekend, but you aren’t really that into live music? No problem… don’t go!

Or MAYBE your friends have booked a spontaneous vacation and are pushing you to jump on board for the long weekend.

As crazy as it may sound, some people just don’t like to travel. If you are one of these people, don’t worry about missing the trip.

All of these things can be really enjoyable for some; but for others, they don’t rank very high on the scale of things they really care about.

The whole point is to take note of what YOU truly love and are passionate about. Then, actively search out ways to spend more time and money doing those things, and cut out the other stuff that you don’t really care about, but seem to always pop up and pull at your wallet strings…

HIDDEN EXPENSES THAT ARE HIDING IN PLAIN SIGHT

Sometimes there can be “hidden” expenses in your life, and because you aren’t being conscious about your spending, they are going unnoticed.

Take for example a friend of mine…

Just this past week he told me he and his wife finally went through their spending for the first time, ever! He went line-by-line, see where their money was going.

He found that they were spending over $100/month on subscriptions that were no longer being used. He was startled to find this out, and immediately went online and cancelled all of those subscriptions.

For him it was a truly eye-opening experience, and a nice money saver!

THE SPECTRUM OF SPENDING

Back to my client…

Even as I sat there chatting with my new client, I could tell she was struggling to break through the psychological barriers around her spending. She was feeling the guilt that so many do when they spend.

That’s when I brought up what I call the “Spectrum Of Spending.”

Everyone falls along it somewhere – From Y.O.L.O at one end, to NOGO at the other.

“Y.O.L.O” – You Only Live Once.

“NO GO” – You say “No Go” to most things.

At one end, you have the mentality “Live as if there is no tomorrow.” YOLO, am I right?!

Financially, you can’t actually do this. If there was no tomorrow, you could empty your bank account and spend every last dollar without a care in the world.

Most people will still be alive tomorrow, so they can’t commit to something so extreme.

At the other end of the spectrum is “hermit” status, where you cut your expenses as low as possible and spend none of your money beyond the absolute necessities – food, shelter, water, etc.

You are literally only spending to stay alive – that’s it. You don’t go out with friends for dinner, see movies, or any other activities that require spending money. Anytime they ask, you tell them “Sorry, that’s a no-go.”

Neither of these extremes is advised. The first isn’t really feasible, and the second is a miserable existence. Not what I’d call “increasing the quality of life…”

UNDERSTANDING YOUR HAPPY PLACE

As I continued to explain this concept to my client, we discussed the importance of finding the right place for her on the spectrum of spending. The place where she can intentionally spend on the things she loves and cares about, but also feel confident that she is doing enough to plan for the future.

It started to make sense for her…

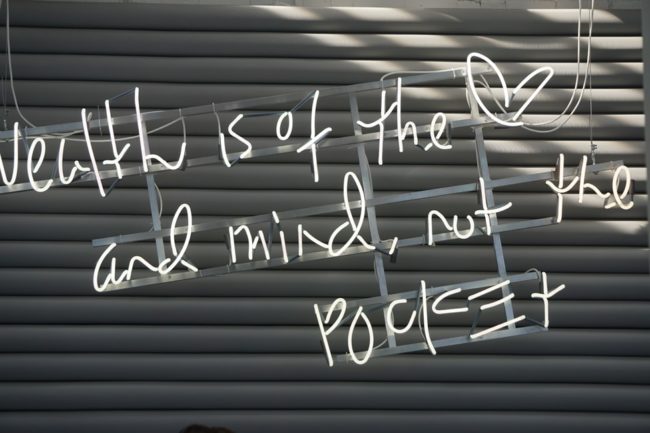

The key in this is to understand that you don’t need to have the same aspirations of wealth-building as your friends. They might want to become a billionaire, but you might just want to feel confident about your future while being able to enjoy your rest and relaxation, in the present.

There is no right answer to the question “Where should I sit on the spending spectrum?”

But for goodness sake, don’t get too close to either end.

Capably Yours,

Jared