I hate budgeting. I’ve discussed this in past articles, as well as on the Capable Wealth Podcast.

I also hate bargain-hunting. I don’t want to spend my time going from store-to-store in search of a discount on the item I want to buy. I’d much rather find what I want, and then negotiate or ask for a discount.

A RECENT CONVERSATION

The other day I was chatting with a friend about saving. She has been focused on saving, paying off debt, etc. Not unlike a lot of the readers of this blog.

So, when I said that I hate budgeting and focusing on cost-savings, she was a bit taken back and confused.

She wanted to know why a Certified Financial Planner would say something like “I hate budgeting” when so much of the finance industry advocates focusing on cost-savings and “living within your means.”

LIVING INSIDE OF A BOX

A problem I’ve seen with a lot of the advice given by financial planners is that it’s narrow-minded.

The advice focuses on the parameters set by the individual’s current situation – meaning, they’re only focused on how to help you save more of your current income, instead of help you earn MORE income.

Another issue is that a lot of the advice given is only focused on the best decision based solely on the numbers.

They will run a calculation through their planning software, and whatever the better outcome is – based on the numbers alone – is what they’ll recommend.

This is missing a BIG part of the equation – The human side of things.

INTERESTS OVER INTEREST

When you only focus on the numbers, and you leave out the human side of things, you are leaving out the truly important part – you are leaving out the things in life that matter most to a person.

The idea of “Interests Over Interest” that I’ve spoken about refers to the idea that it isn’t bad for you to put your money into the things you are truly interested in and passionate about, even if it means you are foregoing some interest you could have earned by investing the money.

It’s what I say to people when I’m trying to tell them that it’s ok for them to spend their money.

Sure, if you saved every penny and invested it, you’d be in a better financial situation. But, what type of lifestyle would that be, not partaking in anything you love and are passionate about?

After all, financial planning is about optimizing the quality of life, not just the size of your bank account.

WHY I FOCUS ON INCREASING INCOME

So, back to my conversation with my friend…

She was rightfully confused as to why I was poo-pooing the savings side of things.

But, I wasn’t telling her what she or anyone else should necessarily do, I was speaking for myself.

I have a true passion for the process of building businesses. I am currently involved in over half-a-dozen revenue-generating businesses, and I’m sure more will pop up in the future.

When I am doing research about a new industry, and trying to figure out the best strategic play to help grow a business, it really excites me and peaks my interest. I can spend hours reading books, articles, journals, speaking to experience individuals, and planning the next move.

I DO NOT get this same excitement from trying to hunt for the next big discount on a pair of jeans.

But some people do! And that is awesome.

I know people who are constantly talking about a great deal they found, or how they were able to piece together massive savings on a shopping spree.

WHICH IS BETTER?

So, if focusing on cutting expenses and growing income are both valid endeavors, is there one that is better?

I’ve mentioned that you should focus on what you are interested in, but in this case, I do believe there is a better option, and that is to focus on increasing your income.

The 3 charts below show you different scenarios to help illustrate what I’m talking about.

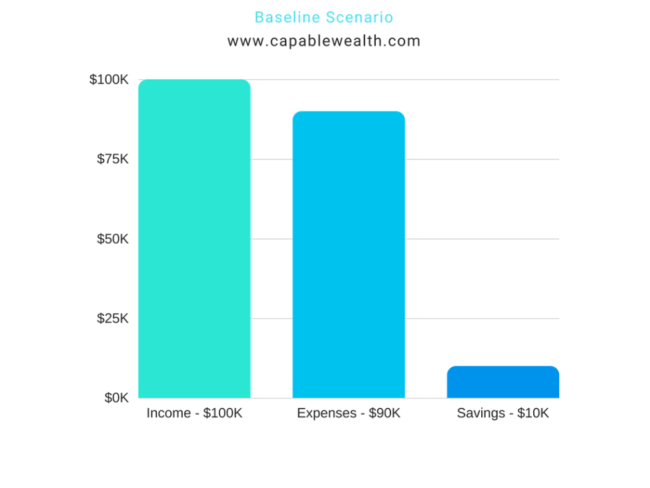

In the first chart, you have a base-line individual. (I always like to use round numbers to make calculations easy, so we’re assuming they are earning $100k per year) This individual earns $100k of income and spends $90K per year on an assortment of expenses. So, they are saving $10k each year.

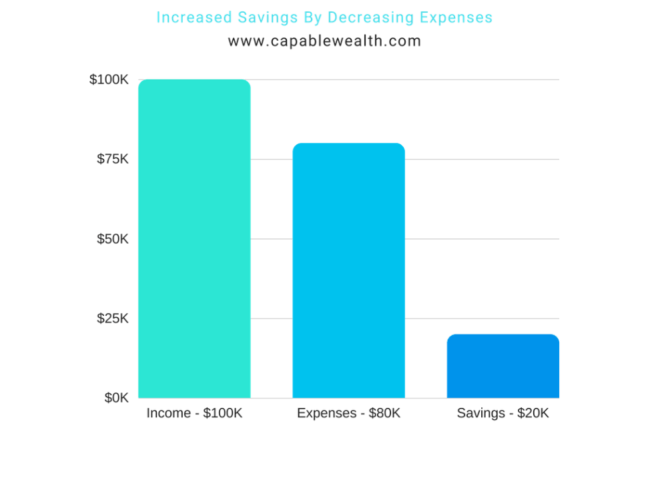

If that person wants to save an extra $10k, they have two choices. They can cut their expenses by $10k, or they can increase their income by the same amount. (I’m not including taxes, etc. in order to make things simple) Of course, they could do some type of mix of the two, but we’re just keeping things simple for this example.

Below, you can see two charts that illustrate this. The first shows a focus on expenses. The second shows a focus on increasing income.

So, it would appear that either choice would get you to the same destination.

NOT SO FAST…

If we go past this person’s goal of saving an additional $10k, and continue to increase their desired savings rate, we run into a problem.

At some point, you can no longer cut expenses.

You might be eager to say that would be at “zero,” but in reality, everyone has a base-line level of expenses they will have trouble going below.

This all depends on your lifestyle, the area in which you live, etc. But you will reach a point where you are having trouble going lower with rent, food, clothing, etc.

You still need the “bare necessities” after all.

UNLIMITED UPSIDE

On the other hand, there is no limit to how high your income can go.

We can get into philosophical discussions on the maximum income of all humans, etc. But the point is, you can keep increasing your income more and more.

There are individuals who are earning in the BILLIONS each year.

SUMMARY

At the end of the day, there are many ways to build wealth. The decision to choose between focusing your efforts on increasing your income or cutting your expenses is one that needs to be considered.

I strongly believe that you should continue to engage in the activities that you are interested in and excite you. Those are the things that you will CONTINUE doing. And after all, maintaining ANY positive financial strategy is better than doing the “best” strategy, only for a short time…

But if you are someone that puts a big focus on cost-cutting and none on increasing your income, you should definitely consider shifting some of your focus to the latter – there is a whole lot more opportunity there!

Capably Yours,