In a recent article about focusing on the right things, I mentioned the importance of putting effort toward increasing your credit score.

“This single number can have enormous effects on your life, ranging from the interest rates you receive for buying a home, getting a personal loan, and it can even affect your ability to get a job.”

The difficult thing about the credit industry is that for the average person, it seems like a black hole. There is a lack of understanding of what goes into your credit score, and trying to deal with the credit agencies is about as enjoyable as getting a root canal.

Before we can understand what steps to take, it’s important to understand what your score is, and how it’s calculated.

ANATOMY OF A CREDIT SCORE

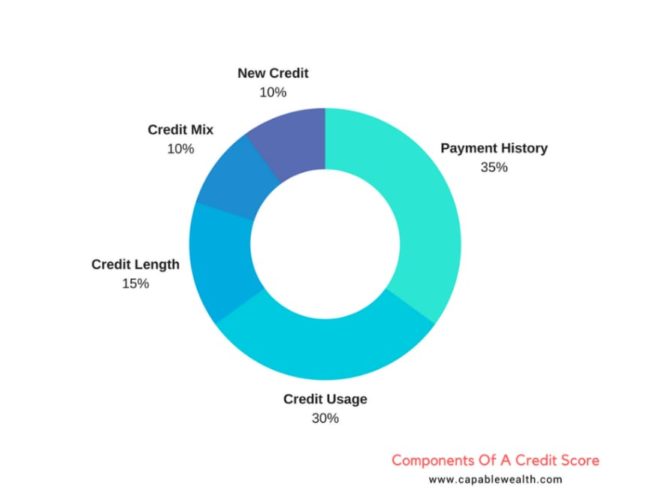

There are five main components that go into the calculation of your credit score as seen in the below chart. I’ll go through each in descending order of importance.

1. Payment History

This is the most important factor, and makes up 35% of the overall calculation of your credit score.

The credit agencies view your past behavior as an indication of how you will behave in the future. So, if you’ve been bad about making payments, you will probably be a risk to any business loaning you money. And if you’ve been very reliable about making payments, you’ll probably be a lower risk.

It is incredibly important to make on-time payments. This is one of the best ways to improve your score over time.

2. Credit Usage

This is the percentage of your available credit that has been borrowed/used, and it accounts for 30% of the calculation of your credit score.

If you have a credit card with a $10,000 limit, and your current balance is $2,500, you are using 25% of your available credit.

“Generally, it is recommended to keep your total credit usage under 30%, but there is no definitive number that optimizes your score.”

In an article on creditcards.com, Tommy Lee, principal scientist at FICO, said that “…the people with the best scores tend to have an average credit utilization ratio of less than 6 percent, with three accounts carrying balances and less than $3,000 owed on revolving accounts.”

3. Length Of Credit History

This refers to how long ago you opened your accounts and the length of time since your last account activity. It accounts for 15% of your overall credit score calculation.

The longer your credit accounts have been opened, the better. Companies want to see a long history of positive behavior. It makes sense that someone who has been paying their bills on time for 10 years would be seen as a stronger borrower than someone who has been paying on time for 10 months.

If you have no credit history, you need to open up an account soon and get your history length building.

While it will take some time for this factor to build up, you can still achieve a good credit score rather quickly by opening some accounts, making on-time payments, and keeping your utilization ratio low.

4. New Credit

This category accounts for 10% of your credit score calculation.

The amount of new credit lines you are opening can have a negative impact on your score. The thought process is that if you are opening a bunch of new credit cards, you could be in a difficult financial situation and in need of lots of available credit, thus making you a risk.

The best recommendation is to only open new credit lines when needed.

5. Credit Mix

This is a rather vague area when trying to determine exactly how it will affect your score.

The overall gist is that if you’ve been able to handle different kinds of loans (i.e. – credit card, mortgage, car payments), then you are more reliable than someone who has only managed one area. So, you’ll most likely score higher if you have a diversified mix of credit accounts.

This category accounts for 10% of the overall calculation for your credit score.

HOW TO IMPROVE YOUR SCORE

Here are the steps you should take to increase your credit score or establish a healthy score if you don’t have one at all.

- Get a copy of your credit report and score

- Check over your report to make sure it is accurate. Check for any false accounts, and make sure your credit limits and utilization are correct.

- Make sure you are keeping your credit utilization ratio low, preferably under 30%.

- Set up your cards and bills for recurring payments, so you never miss a due date.

- Have at least 2 credit cards; one for everyday purchases, and another for all of your recurring payments. Keep the recurring payments card in a safe place at home so you never lose it or get it stolen. This way, even if you lose your wallet, your recurring payments won’t be affected.

- If you have any accounts in collections or behind in payments, you need to focus on paying those off and getting them current.

- For any delinquent bill that is in collections, try to negotiate with the creditor. Write them a letter saying you’ll pay it off if they agree (in writing) to report the account as “paid as agreed” or completely remove it. This can be a huge win if they agree.

- Sign up for a credit monitoring service like LifeLock.

SUMMARY

“When it boils down to it, you really want to focus on the two most important areas: payment history and credit usage.”

These areas will have the biggest impact on your score, and for good reason. It makes sense that a lender would care the most about your past ability to pay on time and if you are frivolous with your spending and tend to take on too much debt.

Focusing on these two areas will give you a solid foundation for generating a strong credit score. The final three areas will help move you from a good score to a great score.

Get out there and score some credit points. It’ll be well worth the effort.

Capably Yours,