Have you ever stopped to think about who it is you’re relying on for your lifestyle?

Most people work for a single employer that makes up their sole source of income. They are reliant on one company, one manager, and one leadership team that is making the decisions that will directly affect their future.

What if that all goes away?

What if one day your company no longer exists? Or the leadership team decides to cut the workforce to “save costs.”

Maybe the industry you work in goes through a dramatic change and the demand for your company’s products dwindles.

There are countless ways it can happen, but you can lose that source of income in a heartbeat.

What will you do if this happens?

NOT JUST ABOUT MONEY

These are all valid points, but they miss a key part of this conversation: CONTROL.

You certainly wouldn’t want to lose your source of income for obvious reasons – being able to pay your bills, support your family, or spending time doing the things you truly enjoy.

But people also miss the fact that when you are reliant on others for your income, you are limited in the choices you can make.

You are beholden to the rules they set – work hours, lunch breaks, vacation days, holidays, etc.

DIVERSIFYING MORE THAN INVESTMENTS

You’ve probably heard that you should be diversifying your investments.

This is simply the concept of not “keeping all of your eggs in one basket.”

However, you probably haven’t heard much about diversifying your streams of income.

I talk about it a lot on my Podcast. For example, episode #18 was about How To Create Passive Income And Stop Working.

Doing this will help protect you from the hardships of losing a job, and it will provide you more control over your life.

A SPECTRUM OF CHOICES

A great way to think about this is to imagine an “Income Stability Spectrum.”

It starts off with no income, then a single job, then adds additional jobs and other streams of income.

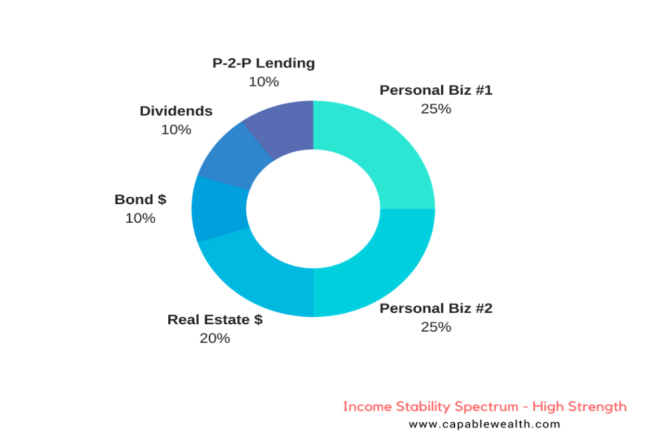

As you move along the spectrum you will hit a place where you own several businesses, and have many streams of income (real estate, bonds, dividend-paying stocks, etc).

You’ll have so many streams of income, that none of them make up a significant chunk of your total income.

In this scenario, you could easily lose multiple sources and still be financially stable.

Here are three examples of progressively better situations to be in.

INCOME STABILITY SPECTRUM – EXAMPLES

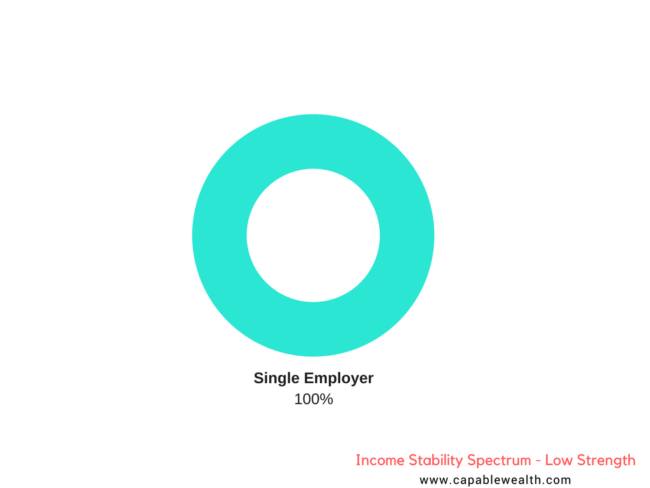

EXAMPLE #1

Income Stability Levels: Single-Employer

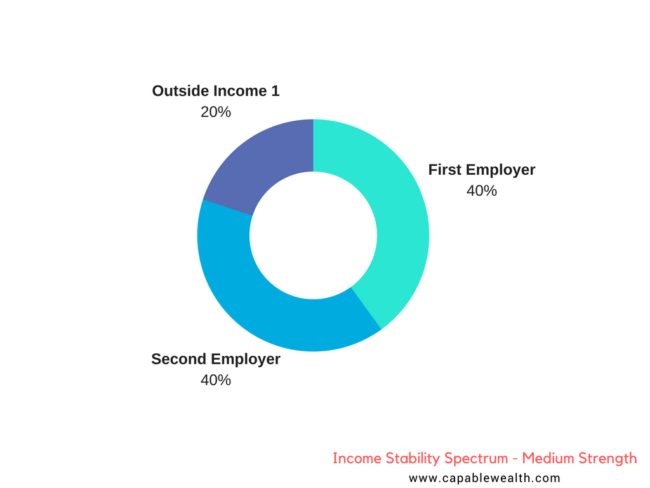

EXAMPLE #2

Income Stability Levels: Multiple-Employers

EXAMPLE #3

Income Stability Levels: Businesses & Additional Income Streams

As you can see, this is showing you the strength and reliability of your income source(s).

As you move along the spectrum, your sources become more reliable and more diversified. Both help to protect you from financial shocks.

FINANCIAL RESILIENCE

To be successful when trying to build wealth, you have to think outside of the box.

If it were easy to do with the typical lifestyle, everyone would be wealthY. But they aren’t…

As you move along your wealth-building journey, avoiding roadblocks becomes crucial to your success.

It is never enjoyable to lose a portion of your income, but if that portion only constitutes 20% of your total income, it will be much easier to deal with than if it makes up 100%.

Capably Yours,

Jared